Complete Story

08/15/2020

Quarterly Research: Uncovering Insights, Impact Of COVID-19

Source: aftermarketNews

Babcox Media Research has tried to keep a close eye on the impact of the pandemic and economic shutdown on the auto aftermarket. In the “early days” of the pandemic, March 31 through April 2, we did a quick survey of 852 respondents in the auto repair, tire, collision and heavy-duty market to establish a baseline to measure the effects of the shutdown over time. We took a closer look at the collision industry in a survey from May 7 through 15 (see “COVID-19 by the Numbers,” June BodyShop Business, p. 38), and a look at the parts manufacturers and distribution network between May 20 and 28 (see “AMN Reader Survey,” June AMN Magazine, p16). As the economy started to open up, we went back and looked at the auto service sector in greater depth in a survey that ran from May 27 through June 14, when we contacted 447 respondents.

Optimism in Auto Service?

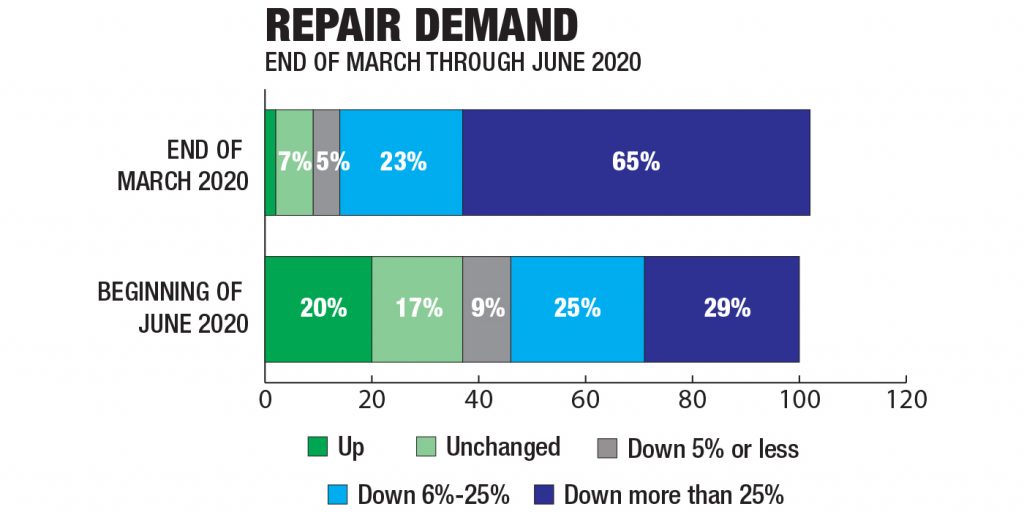

In our first survey that was taken March 31-April 2, we asked about changes in the demand for repairs due to the March shutdowns. In the auto service sector, only 2% of respondents said that demand was up, and 7% said demand was unchanged. On the downside, 5% of respondents said that demand was down 5% or less, 23% said that demand was down 6 to 25%, and 65% reported that demand was more than 25% down.

Now let’s take a look at the follow-up survey taken May 27 through June 14. We asked the same question, but got somewhat better results. Twenty percent of respondents are reporting that demand is up compared to end of March, and another 17% report it is unchanged. The percentage reporting demand is down more than 25% has shrunk from 65% to 29%. These answers may reflect the economic restart that was underway in May.

Shop owners also are becoming optimistic about the future. When we asked owners younger than 55 when they thought their business will get back to normal, 53% said it is already back to normal, and another 17% said it would be back to normal by summer (this article is being written in the last week of June, and in such a dynamic situation there could be changes by the time you are reading this. But this was the shop owner’s viewpoint in early June.).

This optimism is being shared in the collision industry. As reported in BodyShop Business, while over 90% in the collision industry say their business has been disrupted, when they look to the future 14% say their business will be better than ever and 70% think their business will be back to normal. Very similar results were reported in the June issue of AMN – when looking to the future 16% of parts manufacturers said their business will be better than ever, and 74% said it will go back to normal.

What about the Supply Chain?

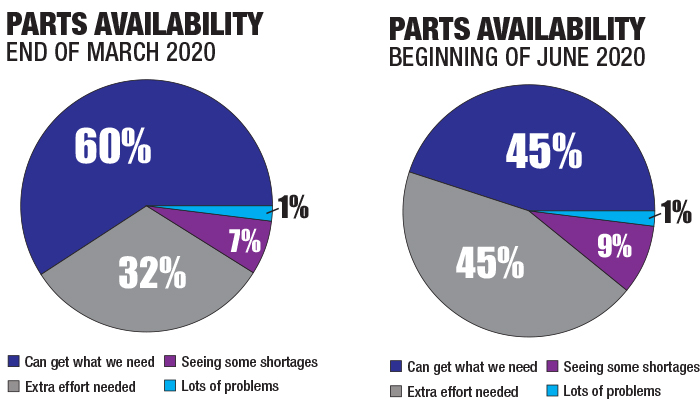

Auto repair facilities, as essential services, in general remained open during the pandemic. An important question was whether bottlenecks in the supply chain may prevent them from getting the parts they need to repair vehicles. We first asked about this in the survey taken at the end of March. Looking just at the respondents from auto repair facilities, 60% agreed with the statement “So far, we’ve been able to get what we need without extra e ort” and 32% agreed with the statement “It’s taken a little more effort to find parts/supplies, but we can get them.” Only 7% said “We are starting to see some shortages.”

The supply chain was growing a little tighter when we asked the same question in the auto service survey conducted between May 27 and June 14. The percentage who said they could get what they needed without extra e ort dropped from 60% to 45%, while 45% now said “It’s taken a little more effort to find parts/supplies, but we can get them.” Only 9% said they are starting to see some shortages, and only 1% said they are having lots of problems. You can see this tightening in Chart 2. Luckily, the growth is in the much less serious category, where they can get what they need with a little more e ort.

Cleaning and Hygiene

We have been checking on the increased hygiene that shops have been implementing. In the June auto service survey, 90% of shops report some increases in cleaning: over 70% report they have increased cleaning in the customer waiting area, just under 70% report increased cleaning in the shop and 61% report increased cleaning of the customer’s vehicles. On the other hand, only 30% say they have mandated masks for staff members and 20% have installed shields at their counters. The average shop reported instituting at least three separate measures for increased hygiene. As we reported in the June issue, 94% of parts stores reported increased levels of cleaning or other hygiene measures.

A Look at the economic indicators

A lot of attention has been paid to key economic indicators such as the unemployment rate as the pandemic and lockdown unfolded. The mainstream media covers those indicators quite well. Another indicator may get less attention yet be more crucial to the auto aftermarket – vehicle miles driven.

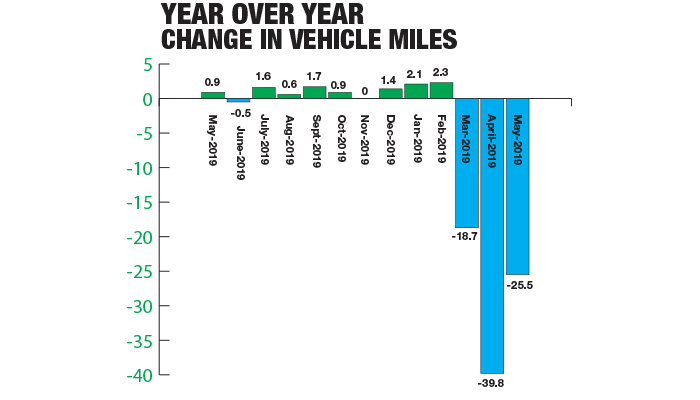

Monthly, the Federal Highway Administration monitors the amount of miles traveled in the US. They do this via more than 5,000 automated traffic counting locations nationwide that are administered by the states. Normally, the year-over-year changes show a slow upward growth rate in miles traveled, with

occasional small disruptions caused by weather. 2020 started out this way, with January 2020 up by 2.1% over January 2019, while February saw a 2.2% increase.

In March, as the lockdown began, vehicle miles traveled was down 18.7%, reflecting about half a month of lockdown. In April, as a result of a full month of lockdown, miles traveled was down 39.8% over April 2019. By May, as shelter in place protocols began to ease up, motorists were getting back on the road, and miles driven was down 25.2%, an improvement over the prior two months.

There are many ways that miles traveled impacts the auto aftermarket – tire replacement and service intervals are closely tied to miles driven. If cars are on the road less, there are going to be less collisions. at makes vehicle miles traveled a key indicator that we will be watching closely as the rest of the year unfolds.