Complete Story

02/04/2023

Top 5 automotive aftermarket trends

Source: aftermarket MATTERS

On the opening day of AAPEX, S&P Global Mobility’s industry analyst Todd Campau presented insights into the emerging top-five aftermarket trends that he sees within the automotive industry.

- Cars getting older, aftermarket stakeholders remain cool about it

Augmented by the lack of new car supply, as well the concerns over economic stability and the constrained new car supply, vehicles are being kept longer and therefore the rates of car parc scrappage are falling. With these historically low levels of scrappage, even with the softer new car sales, the trend is showing that the vehicles in operation (VIO) are continuing to rise. The executives that S&P Global Mobility interviewed did not seem too concerned about this as the effect will not be perceived before five or six years. Meanwhile, for their cousins in the aftersales segment, which typically depend on the 1-4-year-old segment vehicles, the feedback S&P Global Mobility gathered was quite the opposite.

The aging fleet, with vehicles being retained longer, the average age has now risen from just over 11 years in 2012 to 12.2 years in 2022. The most significant growth sector of the fleet is among the 6-13-year-old vehicles, a cohort that was already poised for significant growth in volume prior to the current economic climate, and is showing the most annual miles traveled, marking it an aftermarket sweet spot. These more-traveled vehicles may be on their second or third owner and likely to already be a prime aftermarket customer.

2. Mileage has returned but is different

Annual miles traveled has returned and even exceeded prior pandemic totals, but the composition of the miles traveled have changed as we have emerged from the pandemic. Insights derived from congestion data have indicated that rush hours have not returned to pre-pandemic levels in all locales, while in many locales congestion throughout the day has displayed a slight uptick as drivers are spreading trips throughout the day.

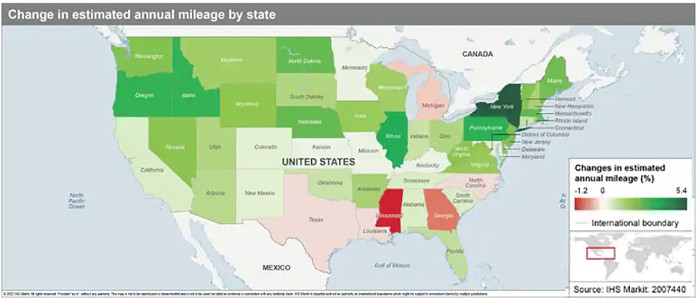

The aggregated effect of the changing vehicle miles traveled (VMT) is expected to add about 1 percentage point to the overall VMT for 2022, increasing to 3.5 trillion miles for passenger cars and light trucks, which will fall within the range of typical year-on-year VMT change prior to the pandemic. That said, the regional change is expected to vary greatly year on year, ranging from a 1.2% decline in Mississippi to a 5.4% increase in New York. Likewise, demand for aftermarket maintenance and repair opportunities based on miles traveled is expected to see varied growth from region to region.

3. Digitization of the workshop as connectivity rises

With vehicle connectivity now enabled with longer serviceable connections, S&P Mobility expects that one-third of the VIO will be connected by 2024 and 5G connectivity will be the dominate service for new vehicles in 2027. By the end of the decade, it is expected that over one-third of the VIO will be connected, and 95% of them will be capable of receiving manufacturer-driven software with over-the-air (OTA) updates.

Diagnostic providers have stated that OTA updates are expected to lead to fewer warranty visits and could reduce revenue opportunities for OEMs. Focus has been on successfully developing relationships with OEMs and securing access to their secure gateways to enable the aftermarket’s ability to complete all repairs. This has given many providers the ability to offer this level of connectivity on a subscription or pay-per-repair basis and also offer technical repair solutions and guidance.

4. Autonomy opportunities

Increased adoption of automatic driver assist systems (ADAS) will continue to penetrate the vehicle fleet at pace. As an example, in 2022, more than 60% of new models have adaptive cruise control compared with about 15% just five years ago. As a share of VIO, the significance of vehicles enabled with adaptive cruise control has risen from 0% in 2015 to 12% in 2022.

To the body repair industry, as the technology continues to penetrate the VIO, it could influence the rates of collision and the increased adoption of cosmetic and smart repair service offerings.

The main opportunities that were presented at AAPEX and Automechanika 2022 were that ADAS systems are a focal point as they were vulnerable to the effects from poor roads conditions and wheel impacts. The importance of ADAS provides an opportunity to service offerings around calibration and safety checks, as well as the associated need to ensure that wheel alignment was checked and adjusted to ensure all ADAS systems remained operational and safe. These services offered a significant revenue and upsell opportunity.

5. Transition to electrification

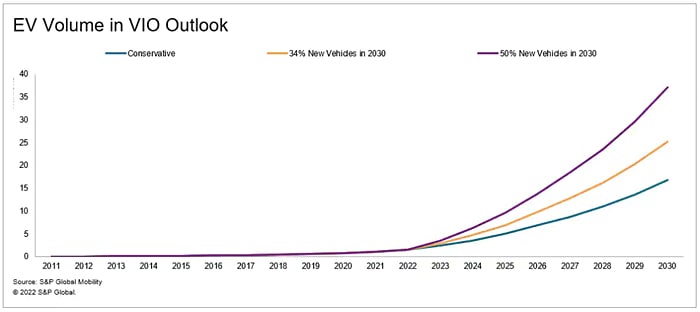

With VIO of 1.4 million electric vehicles (EVs) in the US currently, a conservative estimate puts that total to be close to 17 million VIO by 2030 as new models will increase from 26 in 2021 to more than 250 in 2030. Conservative and aggressive outlooks lead to overall share of the vehicle fleet of less than 15% in 2030 — even as EVs show significant growth in new registrations, transformation of the fleet will take years.

More states are proposing regulations to restrict new registrations to either zero- or low-emission vehicles, and similar trends are following in Europe, which is creating additional influencing factors as to why customers are choosing to adopt EVs sooner. However, recent surveys show continued reticence in consumer acceptance. In 2021, 81% of those surveyed would have considered purchasing a battery-electric vehicle (BEV); however, in 2022, only 58% shared that view. The reason for this change seems to be skepticism toward EV technology, pricing, charging infrastructure, and battery technology being barriers. Pragmatism is strongly encouraged in developing and implementing an EV strategy because while the transition will take time, preparation will be key to a successful future.

Of the new vehicle registrations in 2022 in the US, the light truck sector dominated the electric segment, representing 60% of all EVs registered.

Although there will be challenges, the future of the aftermarket still presents an aging car parc with increased repair opportunities. This aging is likely to continue as the economic influences have a destructive effect on new car sales while the constraints on new car supply are likely to continue through 2024. Although BEV growth is good, the proportion against total VIO indicates there is still caution, with many waiting to gain confidence in the technology and infrastructure before switching to fully electric.